Note that investments in private placements are speculative in nature, that they may be illiquid, and there is risk of principal loss. Securitize has pioneered a fully-digital, regulatory compliant, end-to-end platform for issuing, managing and trading digital asset securities, with nearly 200 businesses and 325,000 investors already connected. Securitize is unlocking broader access to alternative investments by enabling private businesses to raise capital from investors.

In addition to empowering Exodus’ Regulation A offering, Securitize has trailblazed a number of other tokenization efforts:įirst credit rated tokenized fund in Japan, with Sumitomo Mitsui Trust Bankįirst venture capital tokenized funds, with SPiCE VC and Blockchain Capitalįirst security token offering in Japan, with Lead Real Estateįirst security token issued by an NBA player, Spencer Dinwiddie of the Brooklyn Nets Their record raise is yet another major example this year of the movement away from traditional issuance to a digital format,” said Carlos Domingo, CEO and co-founder of Securitize. "We were excited to play a key role in Exodus' raise. “Securitize is the go-to platform for the investor-ready compliant capabilities necessary to invite, onboard and issue digital representations of shares of our Class A common stock to our investors and we look forward to growing our relationship over time.” “Our public offering was an innovative way to give our customers direct ownership in Exodus and that is made possible through our partnership with Securitize,” said Exodus CEO JP Richardson. Securitize is also acting as Exodus’ digital blockchain-based transfer agent. Securitize collected necessary investor information and performed Know Your Client (KYC) checks through its Securitize iD feature, which verifies U.S investors. To enable this groundbreaking offering, Securitize provided two critical services to Exodus. Securities and Exchange Commission’s decision to raise the Regulation A offering limit, companies can now raise up to $75 million in an offering under Regulation A in a 12-month period from individual investors. This news is noteworthy because traditional capital raising methods have generally only permitted accredited investors, private equity firms, or major financial institutions to invest in early-stage, high-growth companies prior to an initial public offering under the Securities Act.

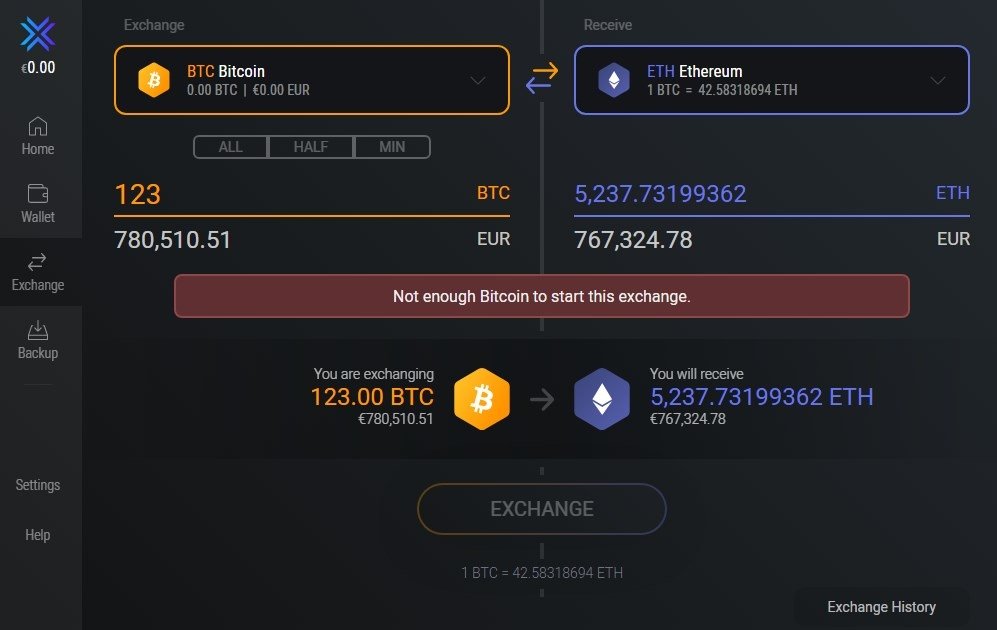

Leveraging Securitize’s technology platform, Exodus, a company that allows its users to secure, manage and exchange crypto assets in a single wallet, has concluded an approximately $75 million offering of its Class A common stock. Securitize, LLC, the leader in empowering private businesses to raise capital in ways that leverage digital assets, today announced that it is enabling Exodus to offer a digital representation of shares of its Class A common stock to its Class A stockholders.

0 kommentar(er)

0 kommentar(er)